Posted By: Bretts Business Recovery Ltd on 13th October 2020

Director of Bishops Stortford car dealership banned after entering into illegitimate contracts with customers breaching arrangements with finance providers 123 Motors Ltd was incorporated in July 2015 and traded as car dealership from premises in...

Read more...

Posted By: Bretts Business Recovery Ltd on 6th October 2020

Boss of holiday parks firm has been banned for 14 years after investors were owed more than £19 million in failed investment scheme. Harlow-based Simon Moir (58) has been disqualified from acting as a director for 14 years. From 22 September, the...

Read more...

Posted By: Bretts Business Recovery Ltd on 30th September 2020

A legally binding agreement between a company (“CVA”), partnership (“PVA”) or an individual (“IVA”) and their unsecured creditors to repay all or part of their debt over a fixed period of time. Negotiating more time to pay your debts...

Read more...

Posted By: Bretts Business Recovery Ltd on 17th September 2020

Bankruptcy is a frightening prospect with lasting implications so it’s no wonder that you may be reluctant to consider it as an option if you’re struggling to pay debts. If your circumstances allow, a Debt Relief Order may prove to be a...

Read more...

Posted By: Bretts Business Recovery Ltd on 15th September 2020

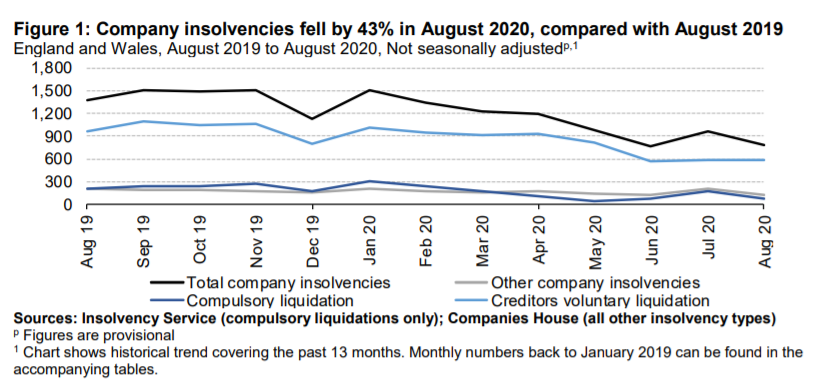

Latest company and individual insolvency statistics remain low overall following July's spike in administrations. The latest monthly release of insolvency statistics for England and Wales was published on 15 September 2020. * Overall numbers of...

Read more...

Posted By: Bretts Business Recovery Ltd on 11th September 2020

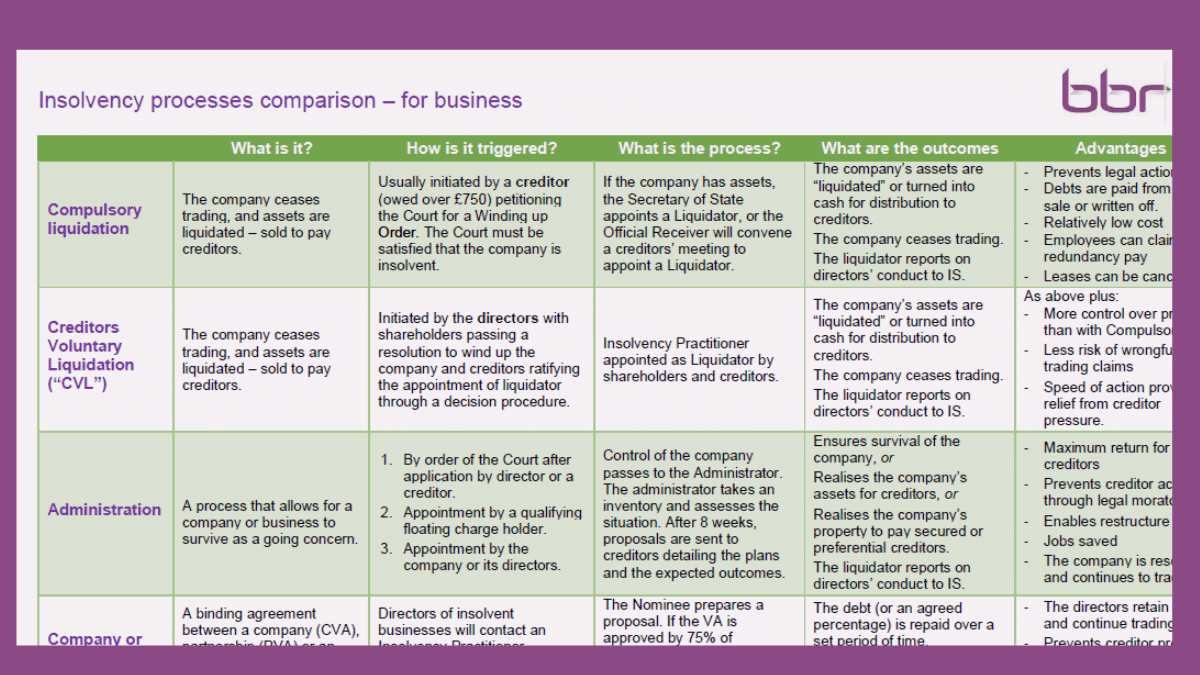

Business insolvency processes - the key points, pros and cons listed in this handy one-page table Download here (pdf): Insolvency comparison - for businesses Or, for a more in-depth overview on each of these insolvency procedures, scroll...

Read more...

Posted By: Bretts Business Recovery Ltd on 10th September 2020

An alternative to Bankruptcy, an Individual Voluntary Arrangement (IVA) is a formal and legally binding agreement between you (as a debtor) and your unsecured creditors (people you owe money to) in which you agree to pay back all or part of your...

Read more...

Posted By: Bretts Business Recovery Ltd on 8th September 2020

Bankruptcy is not a debt solution to go into lightly, but it doesn’t always mean losing your home. In bankruptcy, your assets including your home, your car and other items that you own may be sold and the proceeds used to pay off your creditors...

Read more...

Posted By: Bretts Business Recovery Ltd on 3rd September 2020

Everyone dreads being unable to pay bills but for an unlucky few debt problems can become a life-consuming reality in which bankruptcy may be the best (or only) route out. Bankruptcy is a legal status that, in certain circumstances, may provide the...

Read more...

Posted By: Bretts Business Recovery Ltd on 2nd September 2020

A Liverpool-based publisher was charged with misleading clients into believing they were advertising in magazines that supported the emergency services. Harlequin Print Ltd was wound up in the public interest on 27 August 2020 in the High Court,...

Read more...