Posted By: Bretts Business Recovery Ltd on 30th September 2020

A legally binding agreement between a company (“CVA”), partnership (“PVA”) or an individual (“IVA”) and their unsecured creditors to repay all or part of their debt over a fixed period of time. Negotiating more time to pay your debts...

Read more...

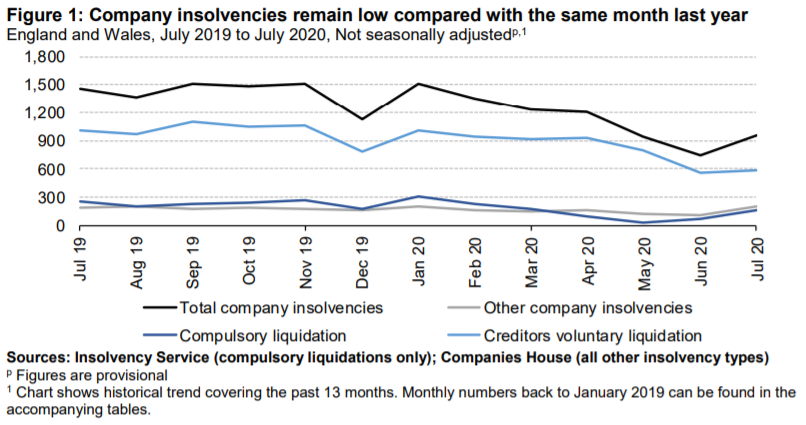

Posted By: Bretts Business Recovery Ltd on 15th September 2020

Latest company and individual insolvency statistics remain low overall following July's spike in administrations. The latest monthly release of insolvency statistics for England and Wales was published on 15 September 2020. * Overall numbers of...

Read more...

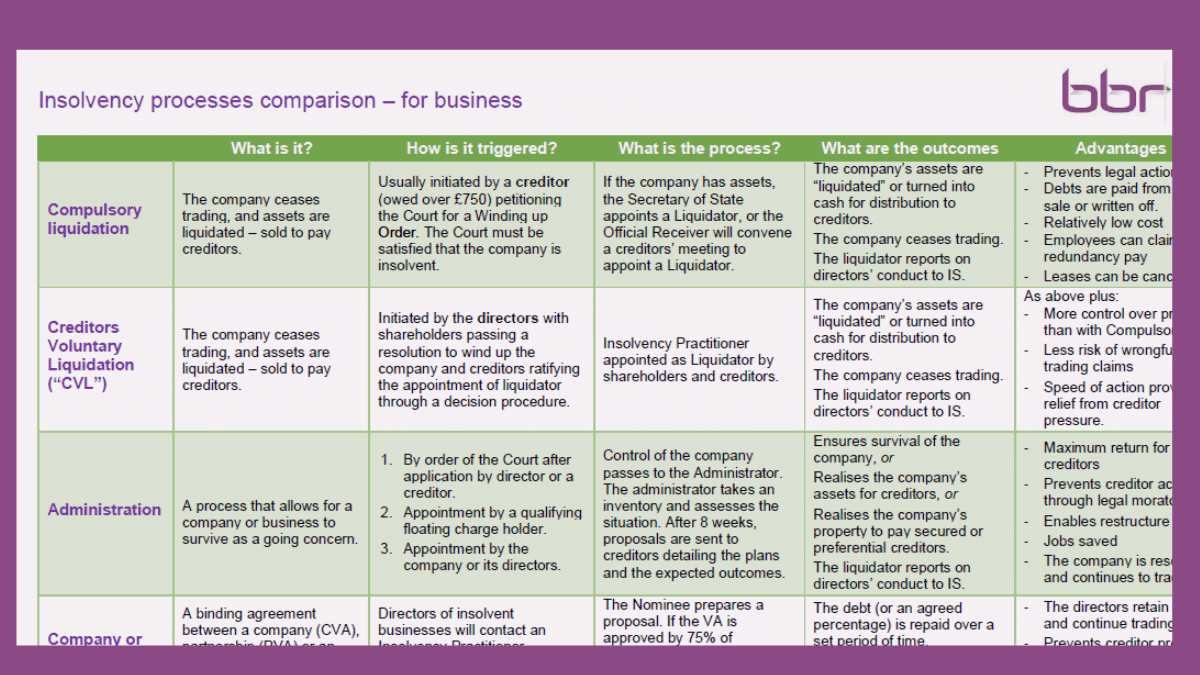

Posted By: Bretts Business Recovery Ltd on 11th September 2020

Business insolvency processes - the key points, pros and cons listed in this handy one-page table Download here (pdf): Insolvency comparison - for businesses Or, for a more in-depth overview on each of these insolvency procedures, scroll...

Read more...

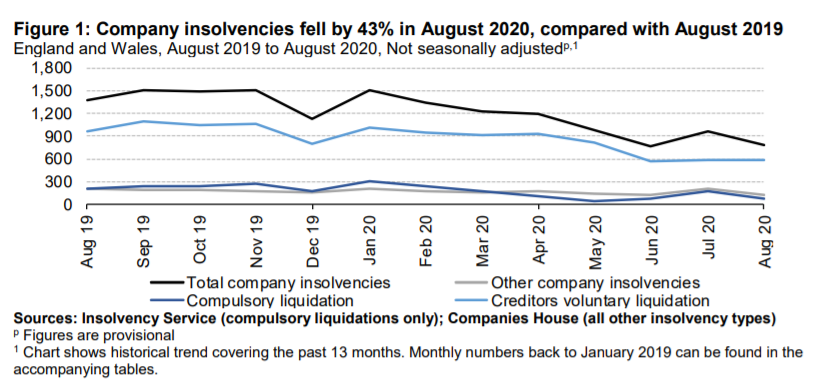

Posted By: Bretts Business Recovery Ltd on 14th August 2020

Latest company and individual insolvency statistics remain low overall, but administrations increase by 25% in July 2020 following the failure of two corporate groups. The latest monthly release of insolvency statistics for England and Wales was...

Read more...

Posted By: Bretts Business Recovery Ltd on 29th June 2020

Despite various business-saving measures, as the COVID-19 crisis continues, it’s increasingly likely that more businesses may confront the realities of insolvency. If your employer is unable to pay creditors it may have to enter a formal...

Read more...

Posted By: Bretts Business Recovery Ltd on 25th June 2020

On 20 May, the Department for Business, Energy and Industrial Strategy (BEIS) announced the new Corporate Insolvency and Governance Bill. The Bill presents a significant reform of the insolvency and corporate governance framework and introduces...

Read more...

Posted By: Bretts Business Recovery Ltd on 4th May 2020

Claims for financial support may be deemed fraudulent if the company was already in trouble when making claims and then later enters into an insolvency process. Insolvency practitioners (IPs) have been advised to remain alert to potentially...

Read more...

Posted By: Bretts Business Recovery Ltd on 6th April 2020

As part of the new measures to support business continuity through the COVID-19 crisis, the Government has temporarily suspended wrongful trading laws for company directors and proposes to introduce other emergency insolvency legislation to aid...

Read more...

Posted By: Bretts Business Recovery Ltd on 10th March 2020

Leading UK business groups and insolvency experts yesterday advised the Government to reconsider its plans to prioritise repayments to HMRC over repayments to other creditors in insolvencies from 6 April 2020. In a joint statement distributed...

Read more...