Posted By: Bretts Business Recovery Ltd on 19th February 2021

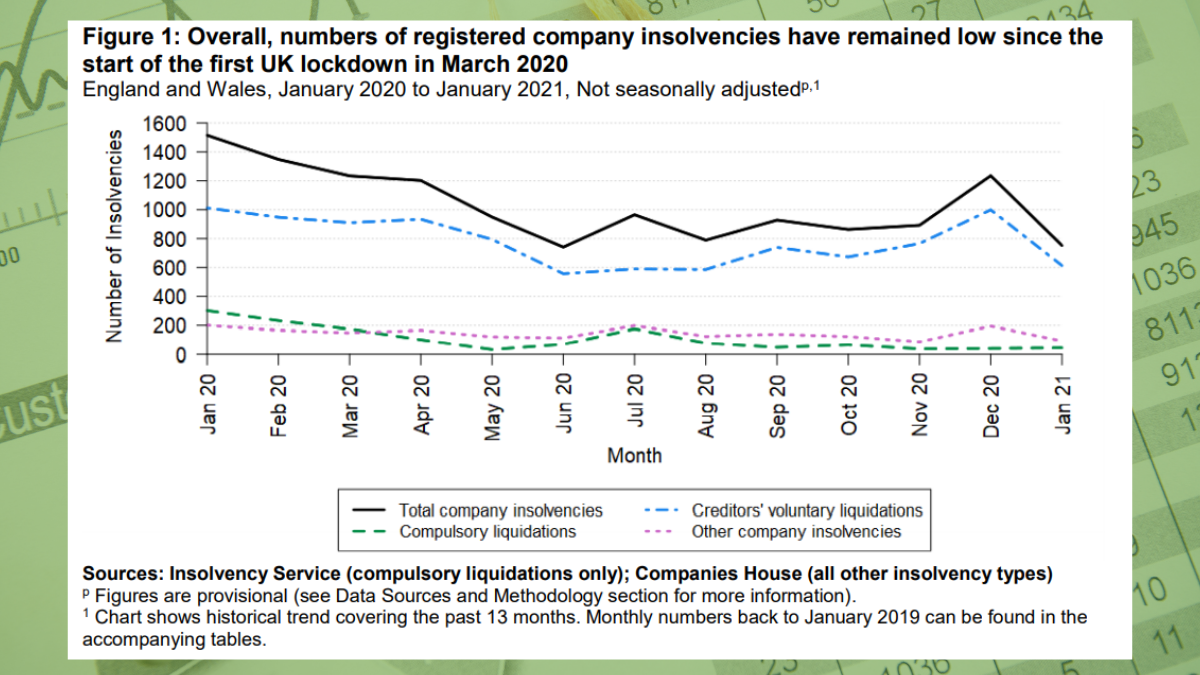

Latest company and individual insolvency statistics remain low. The latest monthly release of insolvency statistics for England and Wales was published on 19th February 2021. * Overall numbers of company and individual insolvencies have...

Read more...

Posted By: Bretts Business Recovery Ltd on 19th January 2021

HM Revenue & Customs (HMRC) has increased the threshold for Self-Assessment taxpayers to use its online self-service Time to Pay payment plan service from £10,000 in tax liabilities to £30,000. This has been put into place to help...

Read more...

Posted By: Bretts Business Recovery Ltd on 15th January 2021

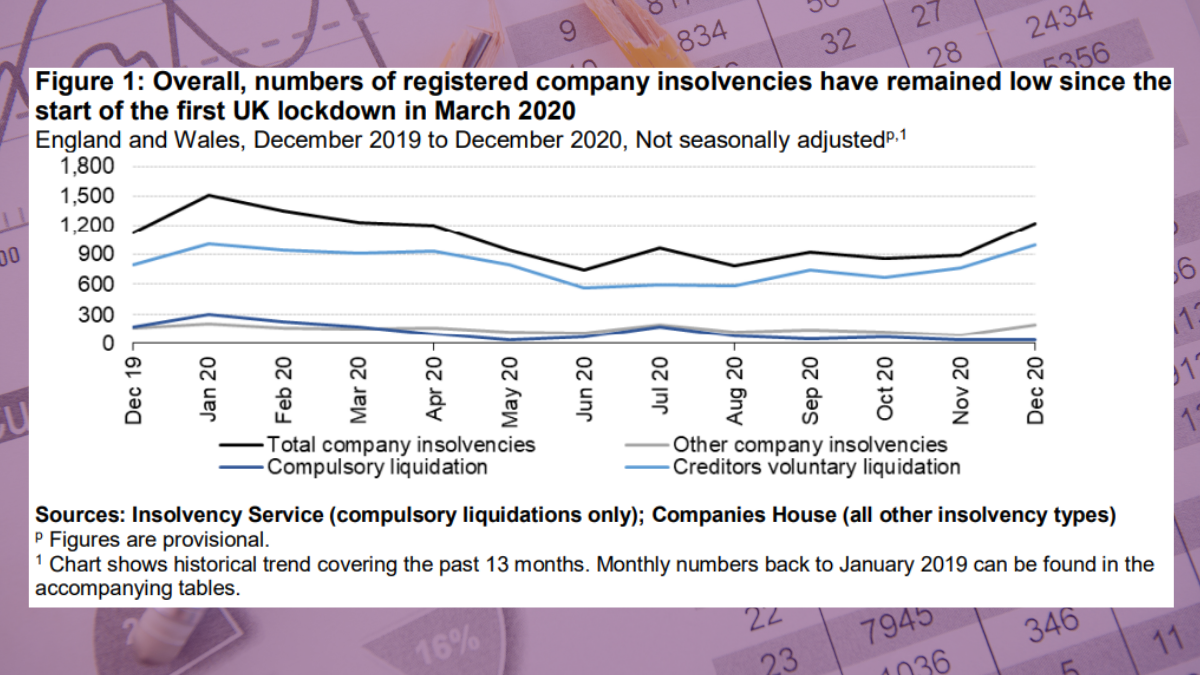

Latest company and individual insolvency statistics remain low. The latest monthly release of insolvency statistics for England and Wales was published on 15 January 2021. * Overall numbers of company and individual insolvencies have...

Read more...

Posted By: Bretts Business Recovery Ltd on 15th December 2020

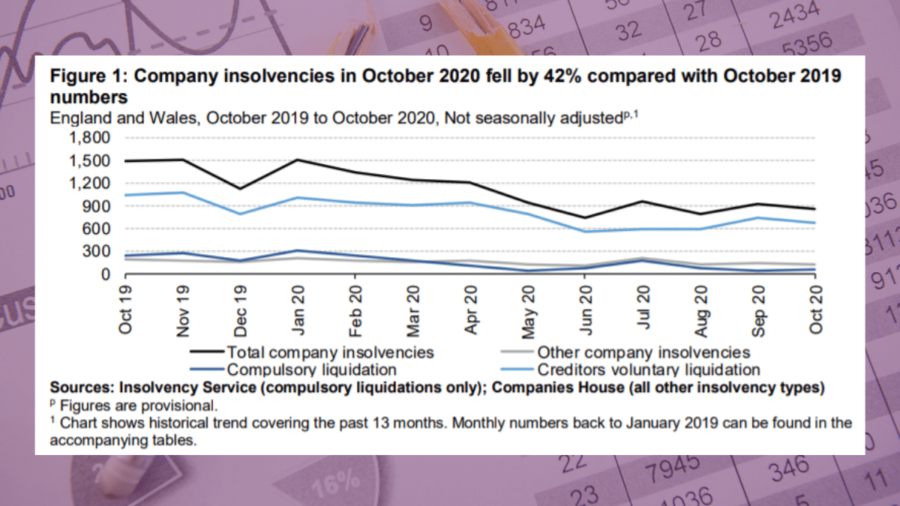

Latest company and individual insolvency statistics remain low. The latest monthly release of insolvency statistics for England and Wales was published on 15 December 2020. * Overall numbers of company and individual insolvencies remained...

Read more...

Posted By: Bretts Business Recovery Ltd on 13th November 2020

Latest company and individual insolvency statistics remain low. The latest monthly release of insolvency statistics for England and Wales was published on 13 November 2020. * Overall numbers of company and individual insolvencies remained low in...

Read more...

Posted By: Bretts Business Recovery Ltd on 11th November 2020

Finance Act 2020 gives HMRC powers to make directors and others connected to a company, jointly and severally liable for the company's tax liabilities if the company becomes insolvent. It’s likely that many businesses will struggle to recover to...

Read more...

Posted By: Bretts Business Recovery Ltd on 9th July 2020

Provisions added to Finance Bill ensure funds received through coronavirus business support schemes are included as revenue for income tax and corporation tax purposes. Recent amendments were made to the Finance Bill which is currently being...

Read more...

Posted By: Bretts Business Recovery Ltd on 7th July 2020

A key provision of The Corporate Insolvency and Governance Act which came into force on 26 June 2020, is to introduce a corporate moratorium – an extendable 20-working day period giving businesses protection from creditor action while they seek...

Read more...

Posted By: Bretts Business Recovery Ltd on 30th June 2020

The Corporate Insolvency and Governance Act has received Royal Assent and came into force on 26 June 2020. The Act, which raced through Parliament in a matter of weeks, introduces new corporate restructuring tools and temporary easements to give...

Read more...

Posted By: Bretts Business Recovery Ltd on 25th June 2020

On 20 May, the Department for Business, Energy and Industrial Strategy (BEIS) announced the new Corporate Insolvency and Governance Bill. The Bill presents a significant reform of the insolvency and corporate governance framework and introduces...

Read more...