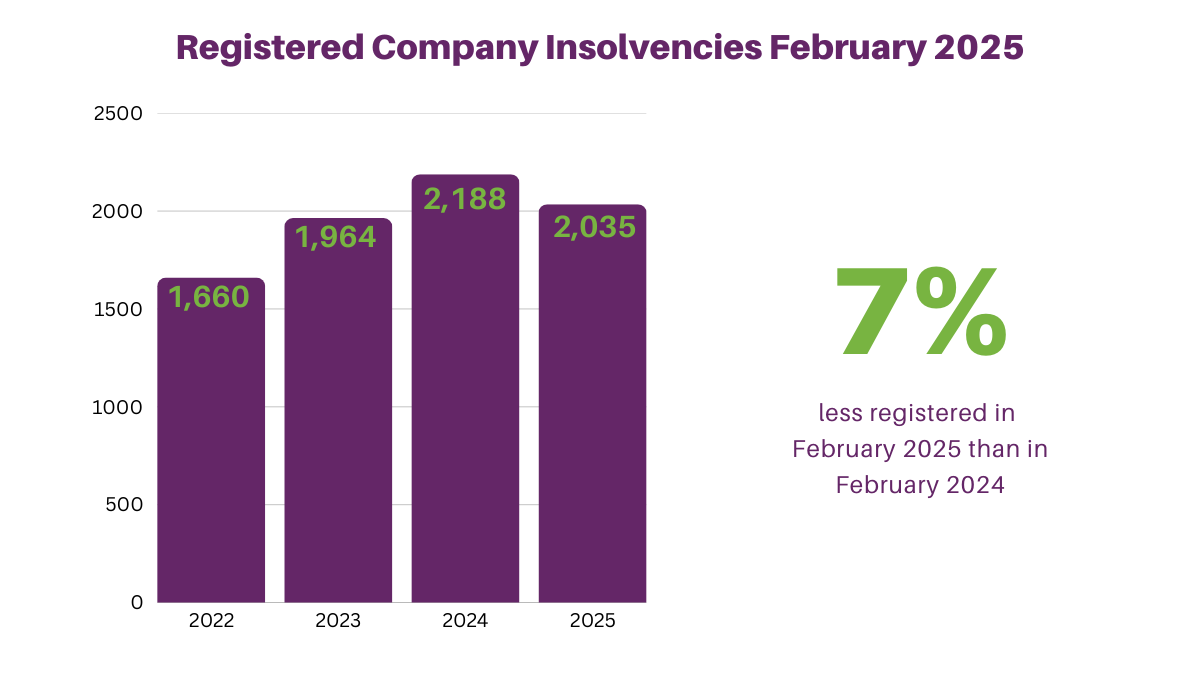

Posted By: Bretts Business Recovery Ltd on 24th March 2025

The insolvency statistics released for February show that of the 2,035 registered company insolvencies: There were 393 compulsory liquidations 1,520 creditors’ voluntary liquidations (CVLs) 115 administrations 7 company voluntary...

Read more...

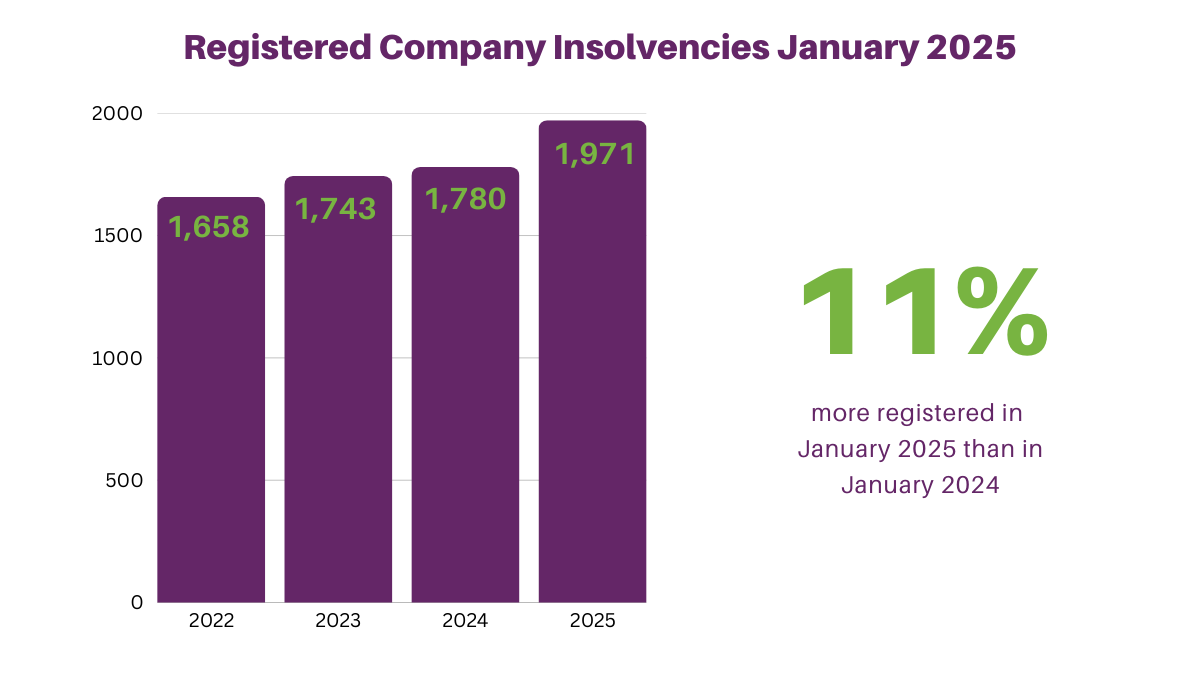

Posted By: Bretts Business Recovery Ltd on 18th February 2025

The insolvency statistics released for January show that of the 1,971 registered company insolvencies: There were 269 compulsory liquidations 1,546 creditors’ voluntary liquidations (CVLs) 142 administrations 14 company voluntary...

Read more...

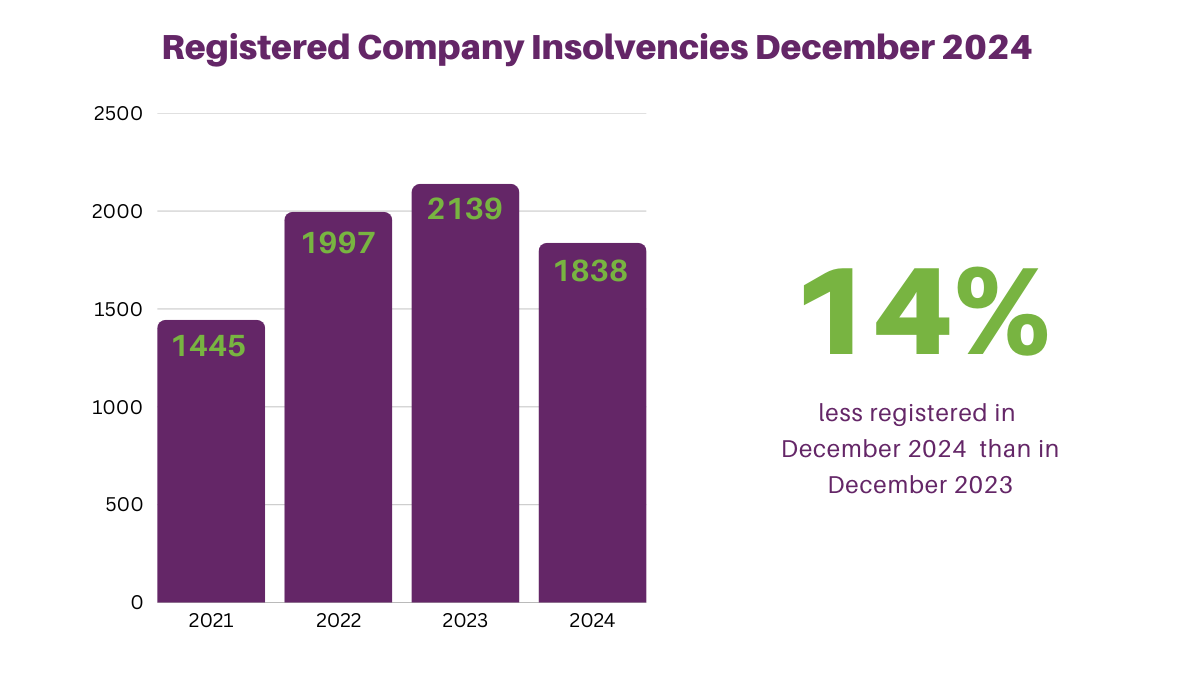

Posted By: Bretts Business Recovery Ltd on 22nd January 2025

The insolvency statistics released for November show that of the 1,838 registered company insolvencies: There were 273 compulsory liquidations 1,421 creditors’ voluntary liquidations (CVLs) 127 administrations 17 company voluntary...

Read more...

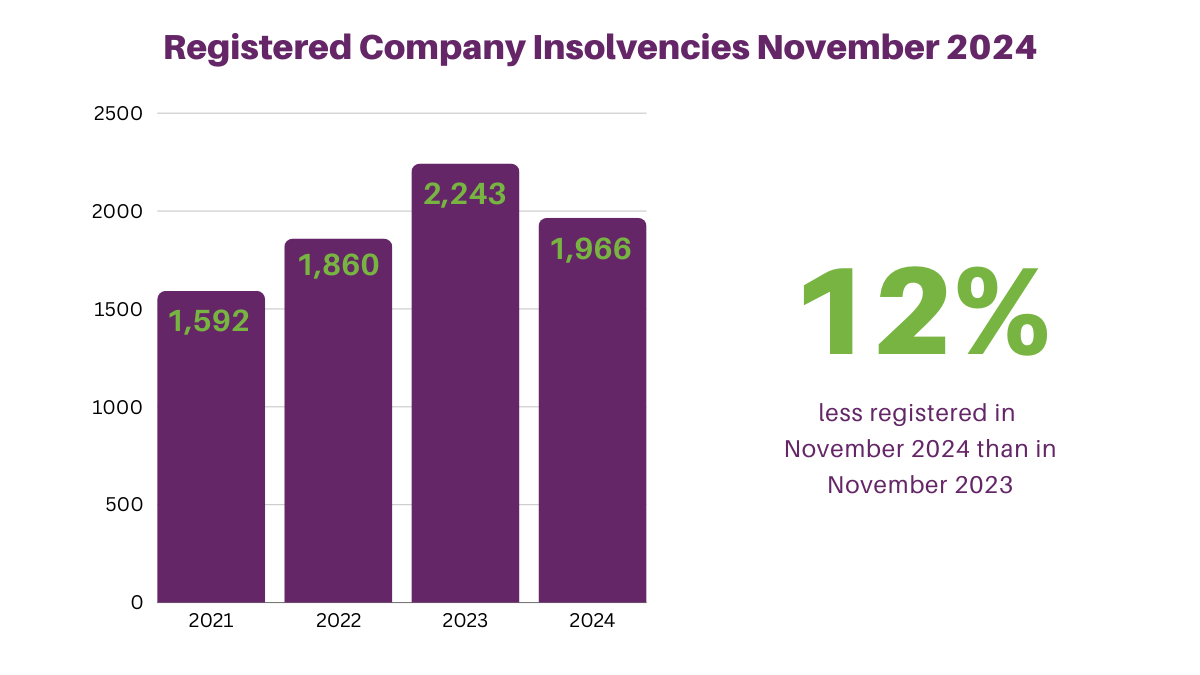

Posted By: Bretts Business Recovery Ltd on 19th December 2024

The insolvency statistics released for November show that of the 1,966 registered company insolvencies: There were 254 compulsory liquidations 1,565 creditors’ voluntary liquidations (CVLs) 132 administrations 14 company voluntary...

Read more...

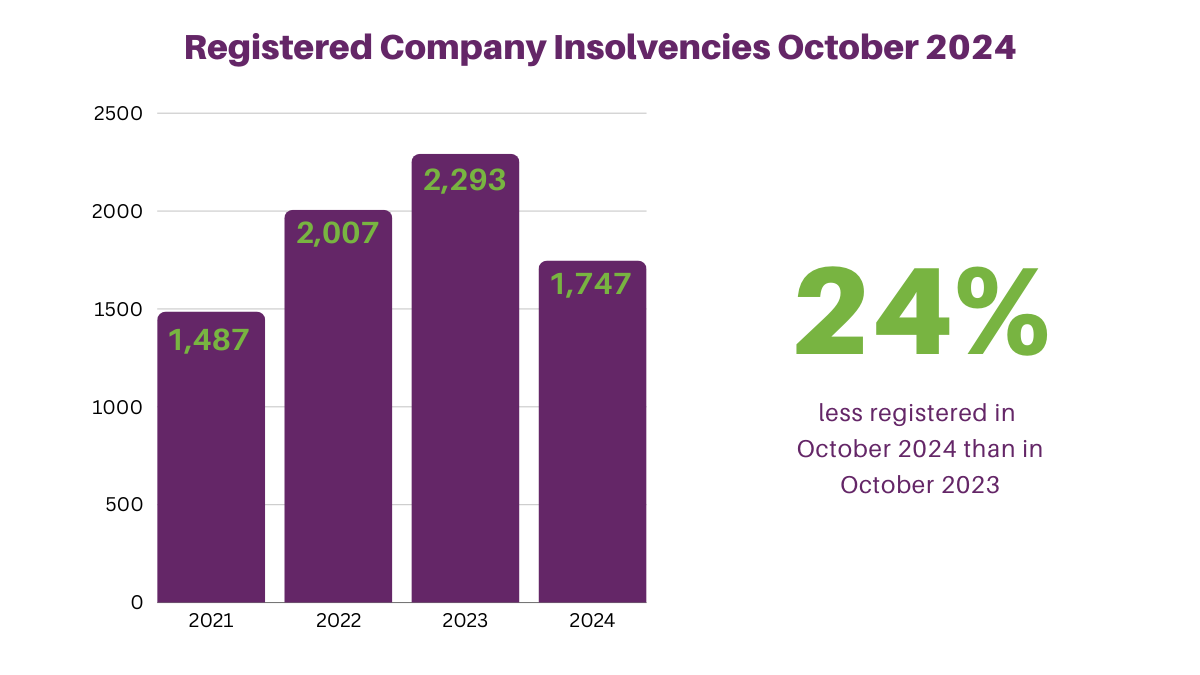

Posted By: Bretts Business Recovery Ltd on 20th November 2024

The insolvency statistics released for October 2024 show that of the 1,747 registered company insolvencies: There were 188 compulsory liquidations 1,445 creditors’ voluntary liquidations (CVLs) 100 administrations 12 company...

Read more...

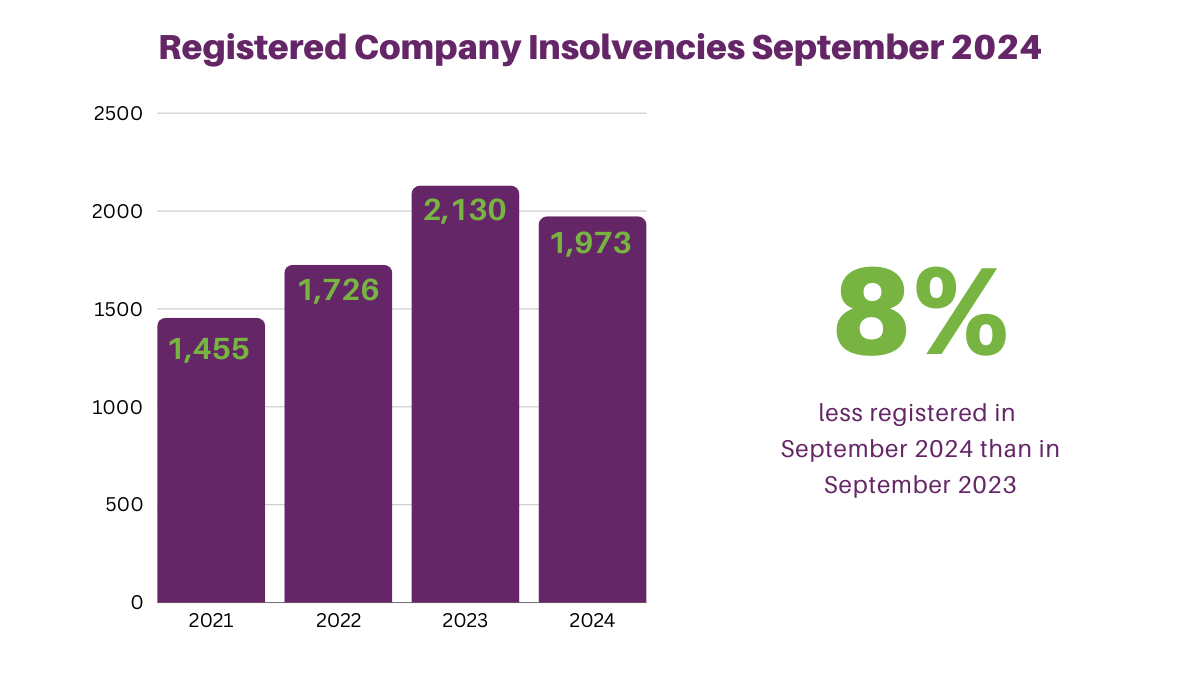

Posted By: Bretts Business Recovery Ltd on 18th October 2024

The insolvency statistics released for September 2024 show that of the 1,973 registered company insolvencies: There were 226 compulsory liquidations 1,575 creditors’ voluntary liquidations (CVLs) 155 administrations 17 company...

Read more...

Posted By: Bretts Business Recovery Ltd on 20th September 2024

The insolvency statistics released for August 2024 show that of the 1,953 registered company insolvencies: There were 279 compulsory liquidations 1,542 creditors’ voluntary liquidations (CVLs) 112 administrations 20 company voluntary...

Read more...

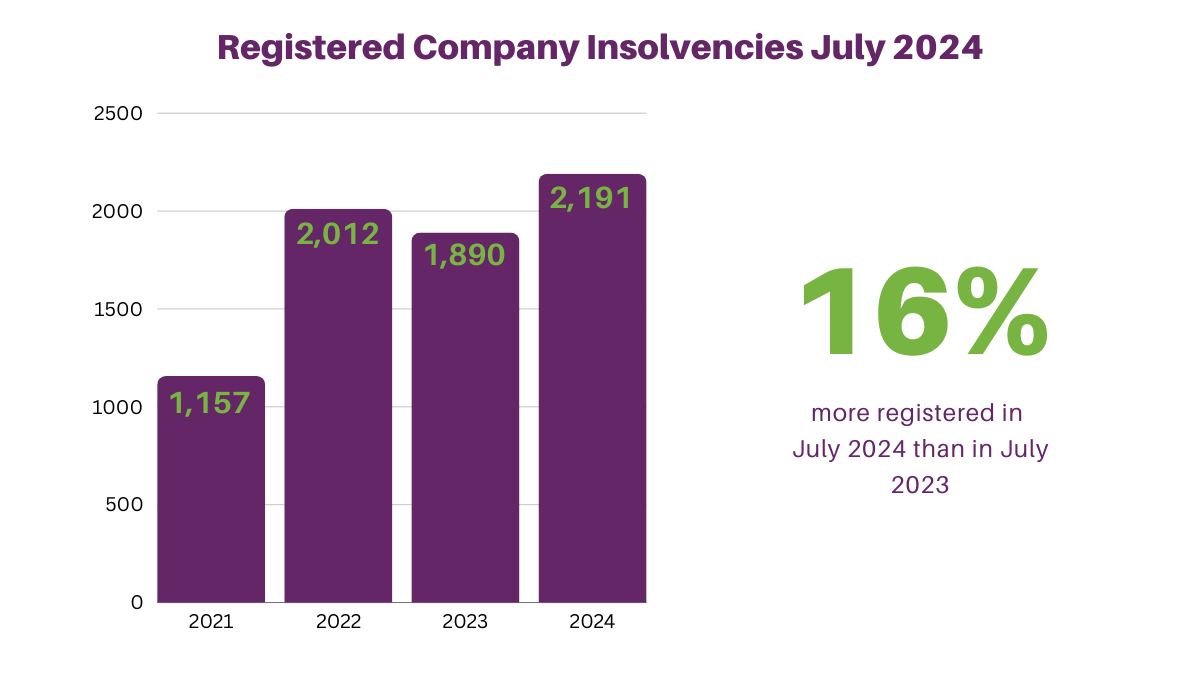

Posted By: Bretts Business Recovery Ltd on 20th August 2024

The insolvency statistics released for July 2024 show that of the 2,191 registered company insolvencies: There were 320 compulsory liquidations 1,691 creditors’ voluntary liquidations (CVLs) 155 administrations 25 company voluntary...

Read more...

Posted By: Bretts Business Recovery Ltd on 31st July 2024

The insolvency statistics released for June 2024 show that of the 2,361 registered company insolvencies: There were 302 compulsory liquidations 1,866 creditors’ voluntary liquidations (CVLs) 1170 administrations 23 company voluntary...

Read more...

Posted By: Bretts Business Recovery Ltd on 3rd July 2024

The director of a fruit and vegetable retailer, who improperly invested more than half of a Covid Bounce Back loan on the stock market instead of using it for his business, has been disqualified and ordered to repay the money. Emra Kayam, 35,...

Read more...